Put Calendar Spread - Additionally, two variations of each type are possible using call or put options. There are two types of calendar spreads: Calendar spreads allow traders to construct a trade that minimizes the effects of time. The forecast, therefore, can either be “neutral,” “modestly. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put. A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. Put calendar spreads, traditionally employed for a neutral to mildly bearish perspective, can be modified for bullish expectations:

Short Put Calendar Spread Printable Calendars AT A GLANCE

Put calendar spreads, traditionally employed for a neutral to mildly bearish perspective, can be modified for bullish expectations: There are two types of calendar spreads: The forecast, therefore, can either be “neutral,” “modestly. A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. A long.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

The forecast, therefore, can either be “neutral,” “modestly. Put calendar spreads, traditionally employed for a neutral to mildly bearish perspective, can be modified for bullish expectations: There are two types of calendar spreads: A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put. Additionally,.

Long Put Calendar Spread (Put Horizontal) Options Strategy

A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. There are two types of calendar spreads: Calendar spreads.

What Is A Calendar Spread Option Strategy Mab Millicent

A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put. A long calendar put spread is seasoned option strategy.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Additionally, two variations of each type are possible using call or put options. A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put. The forecast, therefore, can either be “neutral,” “modestly. Calendar spreads allow traders to construct a trade that minimizes the effects of.

Bearish Put Calendar Spread Option Strategy Guide

Additionally, two variations of each type are possible using call or put options. A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. Calendar spreads allow traders to construct a trade that minimizes the effects of time. The forecast, therefore, can either be “neutral,” “modestly..

Long Calendar Spread with Puts Strategy With Example

Put calendar spreads, traditionally employed for a neutral to mildly bearish perspective, can be modified for bullish expectations: The forecast, therefore, can either be “neutral,” “modestly. Calendar spreads allow traders to construct a trade that minimizes the effects of time. A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the.

Bearish Put Calendar Spread Option Strategy Guide

Put calendar spreads, traditionally employed for a neutral to mildly bearish perspective, can be modified for bullish expectations: Calendar spreads allow traders to construct a trade that minimizes the effects of time. There are two types of calendar spreads: A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased.

Calendar Put Spread Options Edge

Calendar spreads allow traders to construct a trade that minimizes the effects of time. Additionally, two variations of each type are possible using call or put options. Put calendar spreads, traditionally employed for a neutral to mildly bearish perspective, can be modified for bullish expectations: The forecast, therefore, can either be “neutral,” “modestly. A long calendar spread with puts realizes.

Put Calendar Spread Option Alpha

Calendar spreads allow traders to construct a trade that minimizes the effects of time. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. The forecast, therefore, can either be “neutral,” “modestly. A long calendar spread with puts realizes its maximum profit if the.

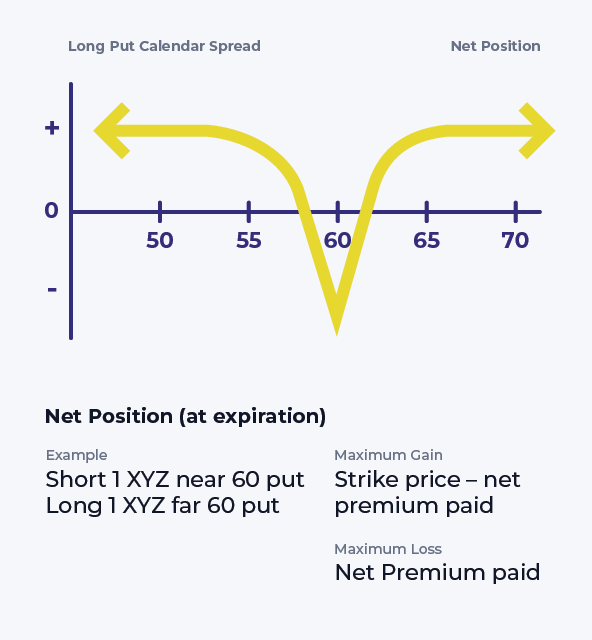

A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. Calendar spreads allow traders to construct a trade that minimizes the effects of time. The forecast, therefore, can either be “neutral,” “modestly. There are two types of calendar spreads: A trader may use a long call calendar spread when they expect the stock price to stay steady or drop slightly in the near term. Put calendar spreads, traditionally employed for a neutral to mildly bearish perspective, can be modified for bullish expectations: A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put. Additionally, two variations of each type are possible using call or put options.

Put Calendar Spreads, Traditionally Employed For A Neutral To Mildly Bearish Perspective, Can Be Modified For Bullish Expectations:

There are two types of calendar spreads: A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. Calendar spreads allow traders to construct a trade that minimizes the effects of time. Additionally, two variations of each type are possible using call or put options.

A Trader May Use A Long Call Calendar Spread When They Expect The Stock Price To Stay Steady Or Drop Slightly In The Near Term.

The forecast, therefore, can either be “neutral,” “modestly. A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/cdn.prod.website-files.com/5fba23eb8789c3c7fcfb5f31/607da29411b814023198cd31_Put-Calendar-Spread-Options-Strategies-Option-Alpha-Handbook.png)

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)